On Wednesday, Donald Trump declared a national economic emergency in the United States and imposed massive tariff increase on all trading partners intended to eliminate, or at least reduce, the American merchandise trade deficit. An increase of 10% on all goods from all countries takes effect tomorrow (March 5) and country-specific increases take effect next Wednesday, March 9. The Dominican Republic is subject to the March 5 tariffs but not the March 9 tariffs.

While unfair trade practices are certain to have affected the sourcing of U.S. imports (China, for example, surely has benefited from them at the expense of third countries), the simple cause of the American deficit is simply that America spends more than it produces. In particular, the U.S. government spends more than it takes in, a gap now up to 6% of U.S. GDP.

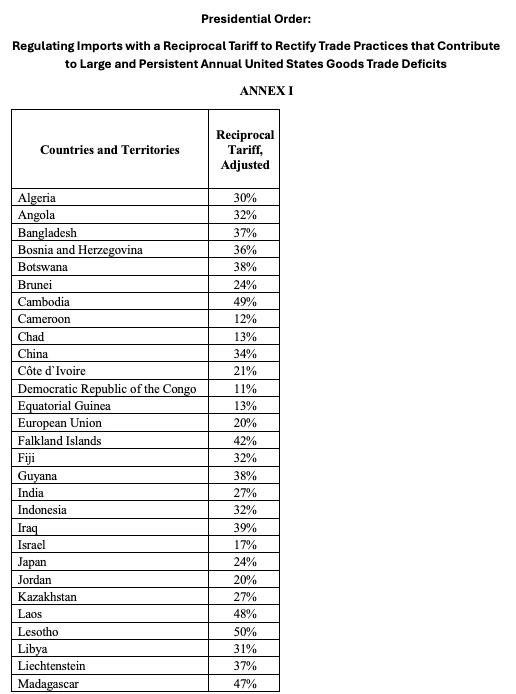

The newly-added March 9 American tariffs on imports will go from 11% on countries without a significant trade deficit with the United States up to 49% the tiny landlocked country of Lesotho in southern Africa (China already had 20% in Trump-imposed tariffs, so with 34% in new tariffs it now faces a cumulative increase of 54%). The country-by-country rates were published in Annex 1 to Trump’s April 2 Executive Order; I reproduce it below.[1]

What does all this imply for the Dominican Republic?

The first thing to say is that this is probably, in the first instance, good news for Domincan exporters. Yes, U.S. buyers will no doubt try to extract price cuts, and the 3% peso devaluation so far this year may help them to cut their prices slightly in U.S. dollar terms. But the U.S. has handed the country a huge competitive advantage vis-à-vis Annex 1 countries: broadly speaking, they gain a 40% edge against China, a 30% edge against Southeast Asia, a 20% edge against South Asia, and a 10% edge against Europe. To the extent that U.S. spending behavior remains unchanged, we would expect to see increased exports to the U.S. from countries not included in Annex 1.[2]

One issue where the outcome is not clear is the statas of the DR-CAFTA free trade agreement. Obviously, the 10% tariff is a violation of that agreement, and we have seen that Emergency Declaration has left Trump free to trample on existing trade agreements. Yet, the 99% Dominican tariff on above-quota rice is also likely a violation. While the Dominican Republic or other member countries could declare the agreement void in the face of this flagrant violation, it is also possible that it can be resurrected, and even the 10% tariff negotiated away, or at least down. Apart from the loss of tariff-free access to the U.S. market, the best course for America’s partners is probably to business as usual at this point.

The sharp rise in uncertainty over Trump administration policies (mainly associated with mass layoffs and contract cancellations instigated by Elon Musk’s DOGE program), together with the changes in the business outlook caused by new tariffs, has led most Wall Street analysts to raise their estimates of the probability of a recession in the United States to 40%-60%, with at least one analyst at 90%--and these are all forecasts before seeing the countermeasures taken by America’s trading partners. While planned tax cuts are likely to more than offset the increased revenue from tariffs, businesses and households tend to face uncertainty by reducing spending. These tariffs are thus likely to help reduce the U.S. trade deficit, just not through the channels the Administration is expecting. So despite a slide in overall demand in the U.S. economy, the Dominican Republic should see a rise in exports there.

Another likely effect of the tariffs is higher prices in the U.S. (and OK, yes, for Dominicans accustomed to buying online for delivery via Florida, or businesses that supply themselves directly from the U.S. market)). Some 70% of the manufactured goods consumed in the United States (including industrial inputs as well as consumer goods) are imported. And manufactured goods directly constitute about 1/3 of consumer spending (along with unprocessed food, housing, and other services). So prices are likely to rise throughout the U.S. economy.

What is not likely to rise? Travel. Indeed, with the U.S. (and perhaps much of the world) in recession, petroleum prices, which have already fallen, in less than 2 days, by $10 per barrel. So air travel (via jet fuel), and stays in the Dominican Republic, are likely to be relatively cheaper. This should help sustain Dominican tourism in the face of a U.S. recession.

And American visitors only constitute half of all visitors. Canadians, hit by Trump’s tariffs and threats to incorporate their country into the United States, are now boycotting U.S. products…and U.S. travel. Florida typically fills with Canadians during the winter. Where will they go now? The Dominican Republic would be a good choice to escape the cold. And even outside the Canadian winter, recent treatment of foreigners in the United States, beginning with the Immigration Service, looks to be cutting sharply into international tourism to the United States. This looks like an excellent opportunity for the Dominican Republic.

Much remains unclear going forward, but, from this initial analysis, it looks like the recent measures provide more opportunities than risks. It will be important for Dominican exporters, and potential exporters, to get to work looking for new markets, and for the tourism industry to step up its promotion of the Dominican brand, both in the United States and elsewhere. In my view, at least, the situation looks more promising than threatening.

[1] It appears that the country-specific rates listed in Annex 1 include both the March 5 and March 9 tariffs, though this is not entirely clear. Annex 1 can be found here: https://www.whitehouse.gov/wp-content/uploads/2025/04/Annex-I.pdf.

[2] Like the Dominican Republic, almost all of Latin America is absent from Annex 1. Only Venezuela and Nicaragua made the list, and not at very high rates.